The profitability of Contract Research Organizations (CROs) has garnered significant attention in recent years, particularly as the global pharmaceutical and biotechnology industries continue to expand. As outsourcing clinical trials and research activities becomes increasingly common, stakeholders in the CRO market—ranging from investors to pharmaceutical companies—are keen to understand the factors that contribute to profitability in this dynamic sector. This article delves into the profitability of CRO in India – Cliniexperts, key drivers influencing their earnings, and the outlook for the industry.

Understanding CRO Profitability

CRO profitability can be influenced by various factors, including operational efficiency, service diversification, market demand, and competitive positioning. Here’s a closer look at these components:

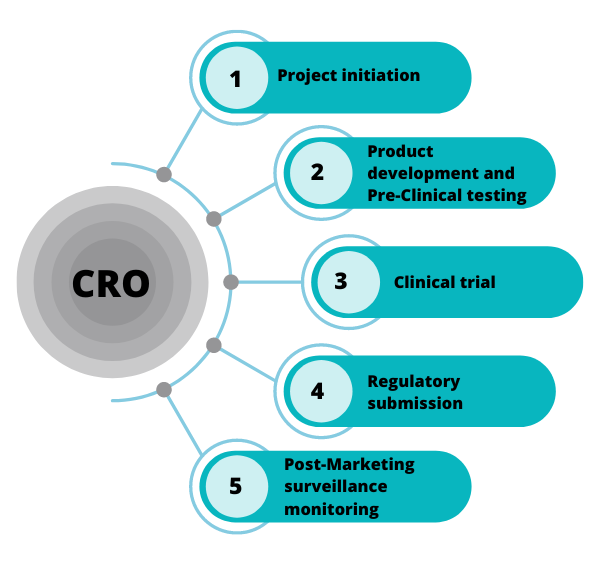

- Revenue Generation: CROs typically generate revenue through various service offerings, including clinical trial management, data management, biostatistics, regulatory affairs, and more. The more comprehensive the service offerings, the greater the potential for revenue generation.

- Cost Structure: A CRO’s profitability is heavily influenced by its cost structure. Lower operational costs, particularly in countries like India, can significantly enhance profit margins. With a large pool of skilled professionals available at competitive rates, Indian CROs are well-positioned to achieve favorable profitability metrics.

- Client Relationships: Establishing long-term relationships with clients can lead to repeat business, which is crucial for maintaining steady revenue streams. CROs that focus on client satisfaction and quality of service are more likely to experience profitability over time.

- Trial Complexity: The complexity and phase of clinical trials can also impact profitability. Phase III trials, which are larger and more complex, typically command higher fees than Phase I or II trials. Thus, CROs that specialize in managing complex trials may enjoy higher profitability.

Factors Influencing CRO Profitability

Several key factors contribute to the profitability of CROs:

1. Market Demand

The demand for CRO services has been steadily increasing, primarily due to the growing number of clinical trials initiated by pharmaceutical and biotechnology companies. As these companies look to outsource their research activities, the resulting demand for CRO services can enhance profitability.

2. Operational Efficiency

CROs that invest in technology and process improvements can enhance their operational efficiency, leading to reduced costs and increased profitability. Technologies such as electronic data capture, remote monitoring, and automated data analysis can streamline operations, allowing CROs to deliver services more efficiently.

3. Regulatory Compliance

Navigating the complex regulatory landscape is a critical component of CRO operations. Successful CROs that maintain high standards of compliance and quality assurance not only build trust with clients but also mitigate risks associated with regulatory violations, contributing to their overall profitability.

4. Economic Factors

Economic conditions can influence CRO profitability as well. In times of economic growth, pharmaceutical companies may increase their R&D spending, leading to more outsourcing and higher demand for CRO services. Conversely, during economic downturns, budgets may tighten, impacting the profitability of CROs.

Financial Performance of CROs

To understand the profitability of CROs more comprehensively, let’s look at some financial metrics:

- Gross Margins: Many CROs operate with gross margins ranging from 30% to 50%, depending on their service offerings and market positioning. Specialized CROs that provide niche services may achieve even higher margins.

- Profit Margins: Net profit margins for successful CROs can range from 10% to 20%. However, this can vary based on factors like company size, service complexity, and regional operational costs.

- Growth Rates: The CRO market is expected to grow at a compound annual growth rate (CAGR) of approximately 15-20% over the next several years. This growth presents opportunities for CROs to enhance their profitability as they scale operations and expand service offerings.

Challenges to Profitability

While there are numerous avenues for profitability, CROs also face challenges that can affect their financial performance:

- Intense Competition: The CRO industry is highly competitive, with numerous players vying for market share. This competition can lead to pricing pressures, impacting profit margins.

- Regulatory Challenges: Regulatory changes can pose challenges for CROs, necessitating investments in compliance and quality assurance processes that may impact short-term profitability.

- Client Budget Constraints: Budget constraints faced by pharmaceutical companies can affect their outsourcing decisions, potentially limiting the demand for CRO services and impacting profitability.

Future Outlook for CRO Profitability

The outlook for CRO profitability remains positive, driven by several trends:

- Increased Outsourcing: The ongoing trend of outsourcing clinical research activities is expected to continue, creating opportunities for CROs to grow and improve profitability.

- Technological Advancements: The integration of advanced technologies will enable CROs to deliver services more efficiently, reducing operational costs and enhancing profit margins.

- Global Market Expansion: As CROs expand their presence in emerging markets, they can take advantage of lower operational costs while tapping into growing demand for clinical research services.

- Value-Added Services: CROs that offer value-added services, such as patient engagement solutions and advanced analytics, will likely enhance their competitive positioning and profitability.

Conclusion

The profitability of CROs is influenced by a multitude of factors, including market demand, operational efficiency, and the ability to navigate regulatory landscapes. With gross margins ranging from 30% to 50% and net profit margins of 10% to 20%, many CROs demonstrate solid financial performance.

Organizations like CRO in India – Cliniexperts are well-positioned to capitalize on these trends, providing high-quality services that meet the needs of the pharmaceutical and biotechnology sectors. By understanding the drivers of profitability and the challenges that lie ahead, stakeholders can make informed decisions that contribute to the success and sustainability of CROs in the ever-evolving healthcare landscape.